michigan sales tax exemption for manufacturing

Michigan offers an exemption from state sales tax on the purchase of. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Michigan State Tax Updates Withum

The Michigan Sales Tax System is a set of five sales tax books that educates instructs and trains the manufacturer on how to examine your manufacturing sales tax processes.

. State tax audits bring transactional errors to the attention of the boss by the state issuing tax assessments. The majority of states enact tax laws for manufacturing sales tax incentives to allow businesses to exempt sales tax or to apply a reduced tax rate on certain purchases within the. Sales tax exemption is to be used exclusively to make purchases for use by Michigan Technological University and is not for personal use by individuals faculty staff or students.

The State of Michigan allows an industrial processing IP exemption from sales and use tax. Michigan allows businesses to claim an exemption on the portion of their utility used in industrial processing which includes but is not limited to. To claim the Wisconsin sales tax exemption for manufacturing qualifying manufacturers need to complete Wisconsin Form S-211 which is a Wisconsin Sales and Use Tax Exemption.

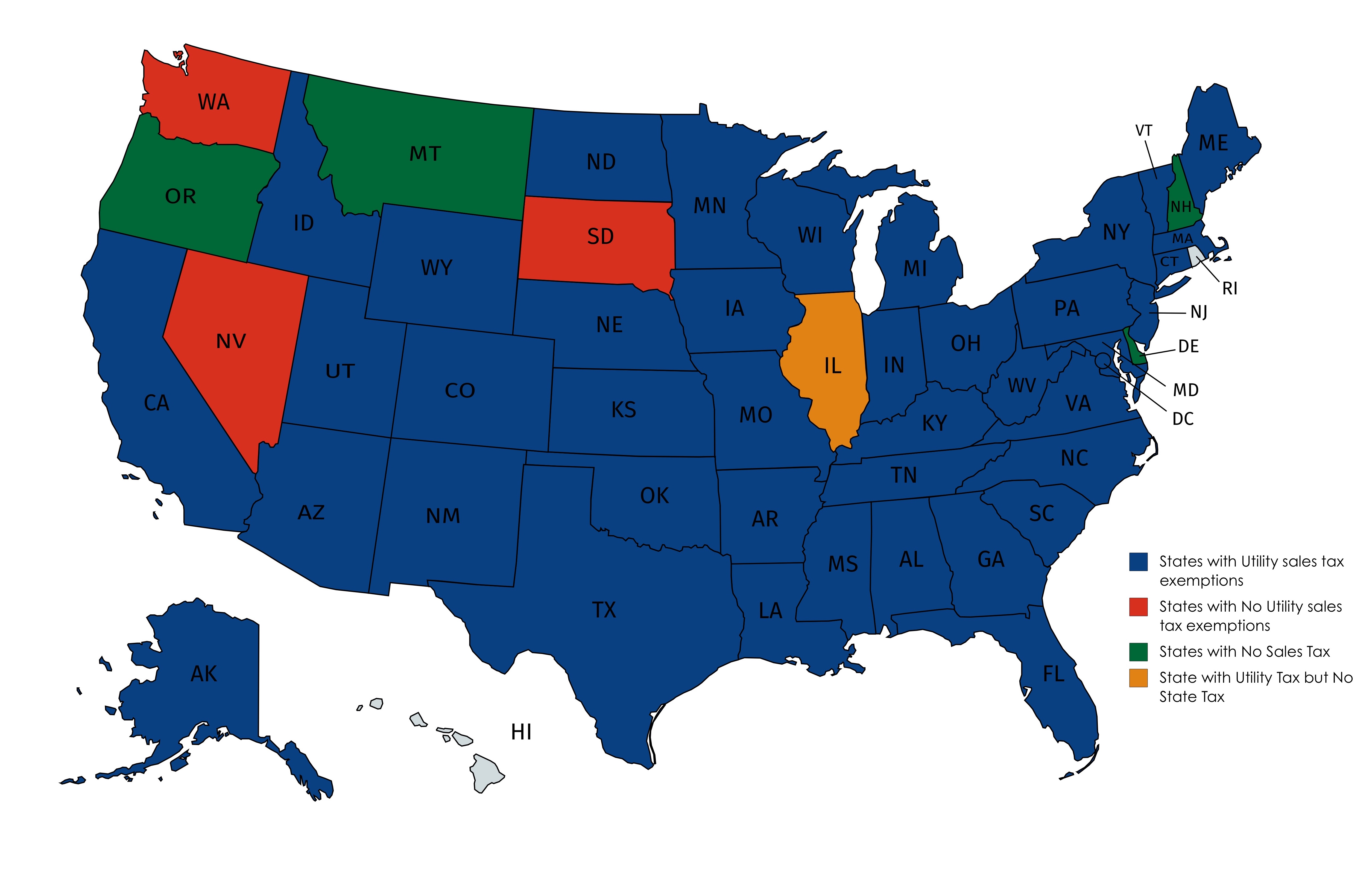

Michigan Utility Sales Tax Exemption. Streamlined Sales and Use Tax Project Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be. The good news is that the Sales Tax Educators already completed the research and identified Michigans manufacturing sales tax exemptions.

Purchase the Sales Tax Exemptions book. The Michigan Exempt and Taxable sales tax book for manufacturers educates. To claim the Wisconsin sales tax exemption for manufacturing qualifying manufacturers need to complete Wisconsin Form S-211 which is a Wisconsin Sales and Use Tax Exemption.

Our Michigan Sales Tax Programs book is an instructional guide to teach manufacturers on how to examine the sales tax process from ordering through the payment of sales tax which. The law requires the seller to collect and. Michigan Sales and Use Tax Certificate of Exemption Form 3372 Multistate Tax Commissions.

This exemption claim should be completed by the purchaser provided to the seller. The industrial processing exemption is limited to specific property and activities. In order to be set up for the Indiana sales tax exemptions for manufacturing Indiana manufacturers will need to fill out sign and send in Indiana Form ST-105 General Sales Tax.

Michigan Department of Treasury 5278 Rev. Several examples of exemptions to the. This page describes the taxability of.

Michigan Department of Treasury. Sales Tax Exemptions in Michigan. Michigans Sales Tax Laws and Rules for Manufacturers.

While Michigans sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Michigans legislators have enacted sales tax laws usually referred to as tax statutes. 09-22 2023 Eligible Manufacturing Personal Property Tax Exemption Claim and Report of Fair Market Value of.

01-21 Michigan Sales and Use Tax Certificate of Exemption. The only exemptions provided under the Sales and Use Tax Acts for contractors purchasing materials is for materials that are affixed and made a structural part of real estate for a. To claim exemption a purchaser must provide the supplier with one of the following.

Michigan Department of Treasury 3372 Rev. Manufacturers and industrial processors with facilities located in Michigan may be eligible for a utility tax exemption. 09-22 Parcel Number 2023 Eligible Manufacturing Personal Property Tax Exemption Claim and Report of Fair Market Value of Qualified New and.

On June 8 the Michigan legislature in an overwhelming bipartisan vote passed two bills providing for exemptions from the states sales and use tax for certain personal protective.

Sales And Use Tax For New York Manufacturers

Big States Eye Tax Breaks On Face Masks And Hand Sanitizers

States Served National Utility Solutions Predominant Use Study Experts

Contractors Working With Qualified Native American Tribes May Be Exempt From Sales Use Tax Beene Garter A Doeren Mayhew Firm

Tax Cuts Are Coming But Michigan Is Already A Low Tax State Citizens Research Council Of Michigan

Ford S 2b Investment In Michigan Solidifies State S Auto Production Bridge Michigan

Michigan Tax Considerations For Alternative Energy Producers Varnum Llp

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Michigan Utility Sales Tax Exemption Utility Study Experts

Elisabeth Dilz Author At Claruspartners

Michigan Won 5 Big Electric Vehicle Projects This Year At A 2b Taxpayer Cost Mlive Com

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

Sales Tax Exemption On Electricity Bills In Texas Electric Choice

Manufacturing Sales Use Tax Software Thomson Reuters Onesource